Bridging Capital, Innovation & Ecosystems

Cross-Border Venture Platform

Partnerships · Co-Investments · Market Entry · M&A

About Us

Building Bridges Across Venture Ecosystems

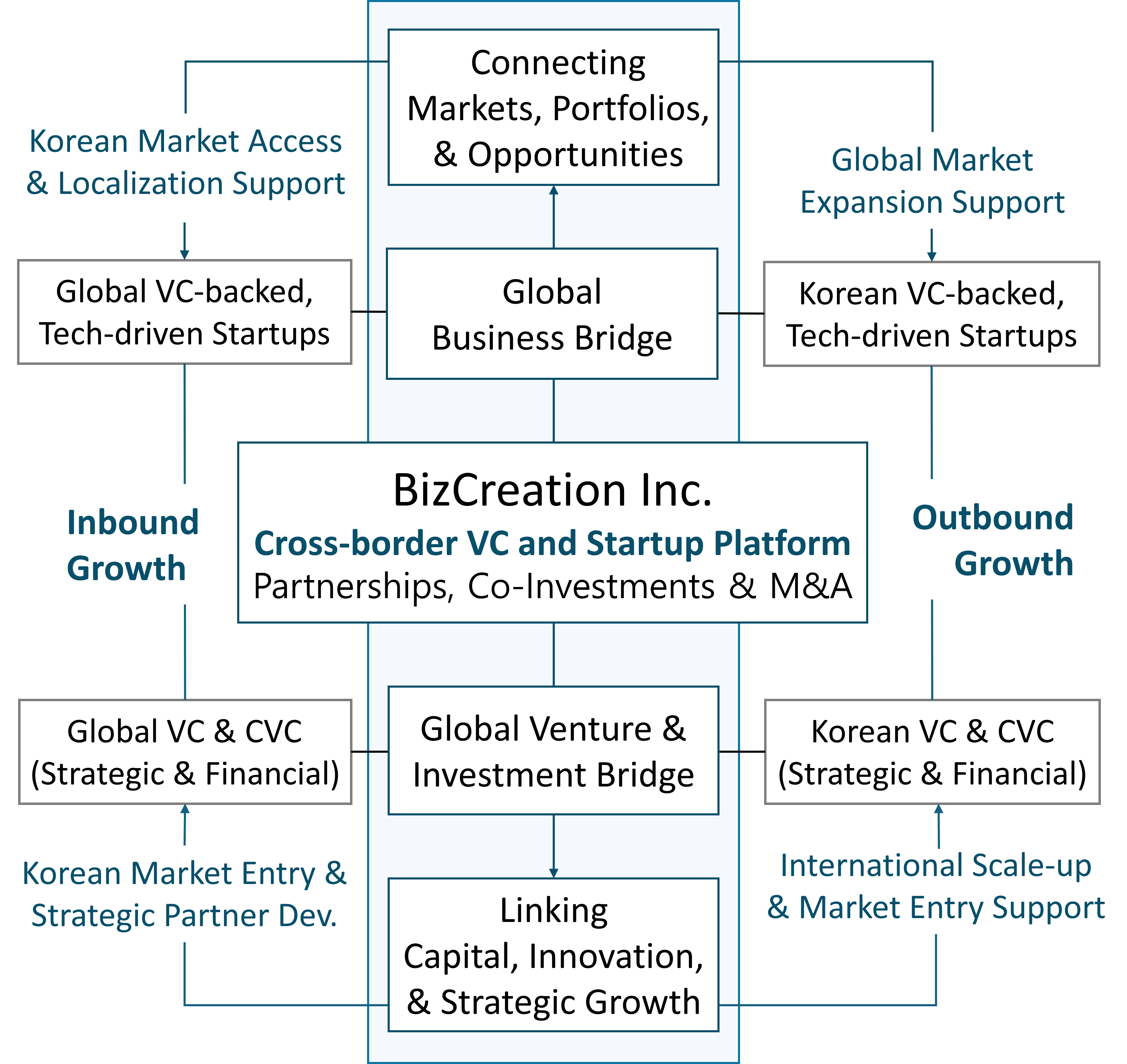

BizCreation enables both overseas investors and startups entering Korea, and Korean ventures expanding abroad—driving partnerships, co-investments, market access, and strategic M&A across global markets.

BizCreation is a cross-border venture platform dedicated to aligning capital, technology, and ecosystems. We support inbound market entry for global investors and startups, while guiding Korean ventures toward international expansion. With deep expertise across the full venture capital cycle and extensive formal and informal networks, our team delivers actionable strategies for partnership matching, co-investments, and value creation. By bridging the Korean VC ecosystem with international markets, we create sustainable pathways for innovation and global growth.

Korea-Based Cross-Border VC and Startup Platform

BizCreation Inc. is a Korea-based cross-border VC and startup platform led by venture capital experts, deep-tech engineers, and technology commercialization specialists. We connect VCs, VC-backed startups, and tech-driven ventures across borders, enabling partnerships, co-investments, and M&A that generate tangible growth.

Helping Overseas Investors and Startups Enter Korea

BizCreation helps overseas VCs, LPs, and startups enter Korea with specialized market access strategies, trusted local connections, and qualified deal flow. We facilitate collaboration with Korean VCs and portfolio companies, ensuring that global partners can identify opportunities and execute partnerships, co-investments, and M&A aligned with their strategic goals.

Supporting Korean Ventures in Going Global

BizCreation supports Korean startups and VC-backed portfolios in expanding abroad by aligning portfolio strengths with international growth strategies. We provide access to overseas investors, markets, and partners—helping startups scale globally through cross-border partnerships, co-investments, and M&A that strengthen competitiveness and enterprise value.

Platform for Creating Sustainable Value

By combining a Korean expert-led team with a trusted global venture network, BizCreation creates execution-ready pathways for both inbound and outbound growth. With expertise that traditional institutions often cannot provide—spanning venture operations, industry insight, and commercialization know-how—we ensure long-term value creation for investors and startups alike.

Inbound & Outbound Growth Platform for Partnerships, Co-Investments, and M&A

Services

Enabling Partnerships, Investments & Global Expansion

We help overseas investors and startups enter Korea and support Korean ventures expanding abroad through curated partnership matching, market access strategies, co-investment syndication, and strategic M&A execution—creating pathways for cross-border growth.

Cross-Border Partnership Matching

We link overseas investors and startups with Korean VCs and VC-backed ventures to build strategic partnerships for joint market entry, technology alliances, and future transactions.

- Matching VC-backed startups across Korea and overseas

- Structuring joint go-to-market initiatives

- Facilitating technology alliances and R&D collaboration

- Preparing the foundation for co-investments and M&A

Market Access & Expansion Support

We guide overseas VCs and startups entering Korea and Korean ventures expanding abroad with market strategies, localization, and on-the-ground liaison support.

- Market entry strategy and localization guidance

- Identifying and securing qualified local partners

- Managing partnerships, investor relations, and on-the-ground operations

- Supporting regulatory navigation and industry-specific adaptation

- Acting as a liaison or branch office in Korea for investors and startups

Co-Investment Syndication

We coordinate cross-border investment rounds with global and Korean VCs, CVCs, and LPs, aligning theses and supporting due diligence to turn connections into actionable, scalable opportunities.

- Structuring co-investment vehicles with global and Korean VCs, CVCs, and LPs

- Aligning investment theses and growth targets between partners

- Facilitating due diligence and valuation alignment

- Building syndicates that reduce risk and maximize scale

International M&A Execution

We manage inbound and outbound M&A—from sourcing and deal matching to integration, delivering value-accretive transactions that accelerate growth.

- Deal sourcing and strategic fit analysis

- Buyer–seller matching across borders

- Transaction structuring and negotiation support

- Post-merger integration planning and execution

- Aligning shareholder and cap-table interests for sustainable outcomes

Experts

Cross-Border Venture Architects

Our experts connect capital, technology, and ecosystems to drive partnerships, co-investments, global market entry, and value-driven M&A.

BizCreation’s experts combine venture capital expertise with extensive cross-border networks, helping startups and investors succeed through curated partnership matching. Each member brings deep knowledge of both the Korean and global ecosystems, enabling collaborations between VCs, founders, and corporates across industries. Beyond investment, they design and execute strategies for co-investments, international market access, and strategic M&A, ensuring that innovation translates into sustainable global growth.

Tae Soo Yang

Venture Capital & Global Ecosystem Architect

Tae has over 20 years of experience across the entire venture capital cycle—from fund formation and investment to value creation and exit. As founder and former CEO of Samho Green Investment and Auditor General at KITIA, he has built a career connecting capital with innovation. He has led cross-border partnerships, co-investments, and M&A execution, directly aligning with BizCreation’s service model. With a deep understanding of the Korean VC ecosystem and extensive formal and informal networks, he connects global investors with high-potential startups to promote growth and international expansion. In addition to guiding transactions, he actively fosters ecosystem links that bring together local and global stakeholders, ensuring long-term value creation across markets. (B.A., Yonsei University; M.S., KAIST)

Jiyoung Tim Kang

Venture Capital & Value Creation Strategist

Tim has led IT and cleantech venture funds at KB Investment and Samho Green Investment, achieving successful exits and earning national recognition, including the Korean Government Minister’s Award. He now oversees Co-Investment Syndication and supports international M&A execution, leveraging his expertise in fund management and exit strategies to help startups expand globally. With a strong interest in emerging industries and the evolving role of venture capital, he identifies new investment opportunities and advises startups on shaping global growth roadmaps. His expertise in fund operations and deal-making allows him to generate tangible value for both investors and entrepreneurs, solidifying his role as a catalyst in the venture ecosystem. (B.S., Seoul National University; MBA, Yonsei University).

Mintae Kim, Ph.D.

Deep Tech Commercialization & Venture Builder

Mintae has 30 years of experience in R&D management, technology transfer, and commercialization. He has published over 30 SCI papers, holds numerous international patents, and has authored several books. As a researcher and business developer, he has turned scientific achievements into market-ready innovations, gaining extensive experience in commercialization. He enhances Market Access & Expansion Support by helping ventures turn deep-tech capabilities into strategic cross-border opportunities. Drawing on his vast experience in academia, industry, and venture collaboration, he plays a key role in connecting innovative research with global markets and supporting startups in creating sustainable growth paths. (B.S., Seoul National University; M.S., KAIST; Phd, Hamburg University of Technology, Germany).

Seungchul Baik, Ph.D.

Technology-to-Market & Venture Growth Specialist

With a metallurgical research background and senior leadership at POSCO—including directing European business and proposing the Global Platform Business concept—Seungchul brings extensive experience in deep-tech commercialization and global market development. He has since launched his own startup, focusing on global growth support, partnership building, and enhancing competitiveness in industry verticals through technology convergence. Leveraging both engineering expertise and international business acumen, he leads Cross-Border Partnership Matching by aligning advanced technical know-how with strategic alliances between investors and startups. (B.S., M.S., and Phd, Seoul National University).

Kyung Chul Min

Venture Capital & Value-Driven M&A Strategis

Kyung Chul brings over two decades of expertise in venture capital, M&A, and corporate restructuring, and currently serves as CEO, managing M&A-focused venture funds. As a senior dealmaker, he has built extensive experience in both strategic and financial transactions, supported by strong networks across the VC ecosystem and multiple industry verticals and horizontals. He has led numerous value-creating strategies through corporate carve-outs and integrations, enhancing outcomes for both companies and funds. His track record in growth and exit strategies makes him central to strategic M&A execution, translating deal structures into value-accretive results. (B.S. and M.S., Ajou University).

Byunghee Suh

Venture Capital & Emerging Industries Strategist

Byunghee brings 20 years of experience at the intersection of engineering and venture investment, now serving as CEO and managing funds in fintech, robotics, and other emerging industries. With a background as both an engineer and a startup CTO, he combines hands-on technical expertise with a proven track record in investment and value creation. He excels in deal sourcing, cross-border partnerships, and market access strategies, ensuring technology-driven startups connect effectively with global VC networks and scale internationally. Drawing on his dual perspective as an operator and investor, he actively supports portfolio companies in refining growth models and contributes to strengthening the broader venture ecosystem. (BS., KAIST).

Tae Hyun Yang

Venture Growth & Industry Partnerships Specialist

Tae Hyun is a recognized authority in protective infrastructure and EMP defense facilities, with extensive experience designing and supervising projects for military bases and national institutions. As CEO of a related startup, he now focuses on adapting proven defense technologies for the civilian sector and building commercialization pathways. Known as a resilient infrastructure strategist, he brings engineering and process management expertise that strengthens BizCreation’s platform through industry partnerships and applied innovation. With active engagements in Korea, the MENA region, and Europe, he contributes to market access and growth opportunities that complement BizCreation’s cross-border venture mission. (B.S., Yonsei University; M.S., Dankook University).

Network

Connecting Global Partners & Opportunities

Through formal and informal networks, we match the right partners and opportunities, aligning strategies that enable cross-border partnerships, co-investments, market entry, and strategic M&A—building pathways for sustainable and scalable growth.

Venture Capital & Startup Associations

Partnering with Korea’s leading VC and startup associations to expand cross-border investments, partnerships, and global growth opportunities.

- Korea Venture Capital Association – National hub for VC firms and investment policy.

- Korea Core Industrial Technology Investment Association – Specializes in critical industrial technology investment.

- Korea Venture Business Association – Represents venture-backed SMEs and entrepreneurs.

- Korea Institute of Startup & Entrepreneurship Development – Supports early-stage startups and entrepreneurship.

- Ministry of SMEs and Startups – Government body driving SME and startup growth.

R&BD & Technology Institutions

Engaging with research and technology organizations to accelerate commercialization, technology transfer, and scalable innovation.

- Korea Institute of Materials Science – Advanced materials research and commercialization.

- Korea Carbon Industry Promotion Agency – Carbon-based materials and industrial innovation.

- Korea Institute for Advancement of Technology – National R&D and tech-industry integration.

- National IT Industry Promotion Agency – ICT and digital innovation programs.

- Korea Environmental Industry & Technology Institute – Green tech and sustainability R&D.

- Korea Electric Power Research Institute – Energy innovation and grid technology.

- Korea Creative Content Agency – Digital media, gaming, and creative industries.

- Korea Institute of Energy Research – Renewable energy research and applications.

- Korea Institute of Design Promotion – Industrial design and creative innovation.

- Korea Fashion Industry Association – Fashion-tech and global retail connections.

- Korea Drug Research Association – Pharma and biotech collaboration.

- Korea Institute of Sport Science – Sports science and wellness technologies.

Business & Engineering Professional Networks

Working with certified professional groups to deliver advisory expertise, technology transfer, and commercialization support.

- Korea Professional Engineer Association – Certified engineers supporting industrial innovation.

- Korea Technology Transfer Agents Association – Specialists in IP licensing and technology deals.

- Korea Management & Technology Consultants Association – Business and management consulting network.

- Korea Consultancy Industry Association – Nationwide consulting professionals supporting growth.

Portfolio

Showcasing Venture Growth in Emerging Industries

Partnerships · Fundraising · Technology Transfer · Growth Strategy

We support startups and ventures through partnership development, fundraising, and Virtual CFO services, technology transfer, and growth strategy execution. The cases highlighted here reflect only part of our ongoing engagements, as we continue to expand collaborations that drive sustainable cross-border growth.

Portfolio Companies Summary

For confidentiality, company names are not disclosed.

Next-Generation Silicon Anode Materials – Pre-A & Bridge fundraising, growth strategy, vertical M&A support.

High-Efficiency Magnetics for EV, ESS & AI Power Systems – Bridge fundraising, scale-up strategy, and global vertical M&A support.

Advanced CNT Composite Materials – Pre-A fundraising, industry partnerships, engineering & R&D collaboration.

Functional Food & Cereal Innovation – Fundraising (Virtual CFO), growth strategy, partnerships, tech commercialization.

Biologics & Biosimilar Development – Series A fundraising (VC syndication), facility expansion financing, IPO strategy.

Open Source Software Security – Growth strategy, partnerships, binary-level OSS compliance & security.

PET Recycling Robotics – Growth & strategy support, AI & robotics for smart waste management.

Wearable ECG Monitoring – Fundraising, growth strategy, partnerships, patent-protected sensing & AI tech.

Automotive Semiconductors – Growth & partnership support, high-speed SerDes & automotive Ethernet.

Level 4 Autonomous Robotics – Growth strategy, VC fundraising, engineering expert & tech transfer support.

Walking Assistance Technology (Elderly Care) – Growth strategy, partnerships, FES-based mobility solutions.

Robotics for Elderly Support – Partnership building, IR readiness, AI datasets for human-robot interaction.

VR Firefighting Simulator – Growth strategy, IR support, VR-based immersive training for safety.

Cellular IoT for Smart Factories – Fundraising preparation, partnerships, ultra-low latency 5G IoT systems.

Satellite Communication ASICs – VC fundraising readiness, IR strategy, lightweight satellite terminal.

High-Sensitivity Non-Contact Sensors – Growth strategy, VC fundraising, ultra-sensitive MoS₂ sensors.

Micro LED SITRAB Technology – Growth strategy, IR system setup, partnerships, cost-efficient micro LED.

And More...

CLICK

for brief case studies on each company

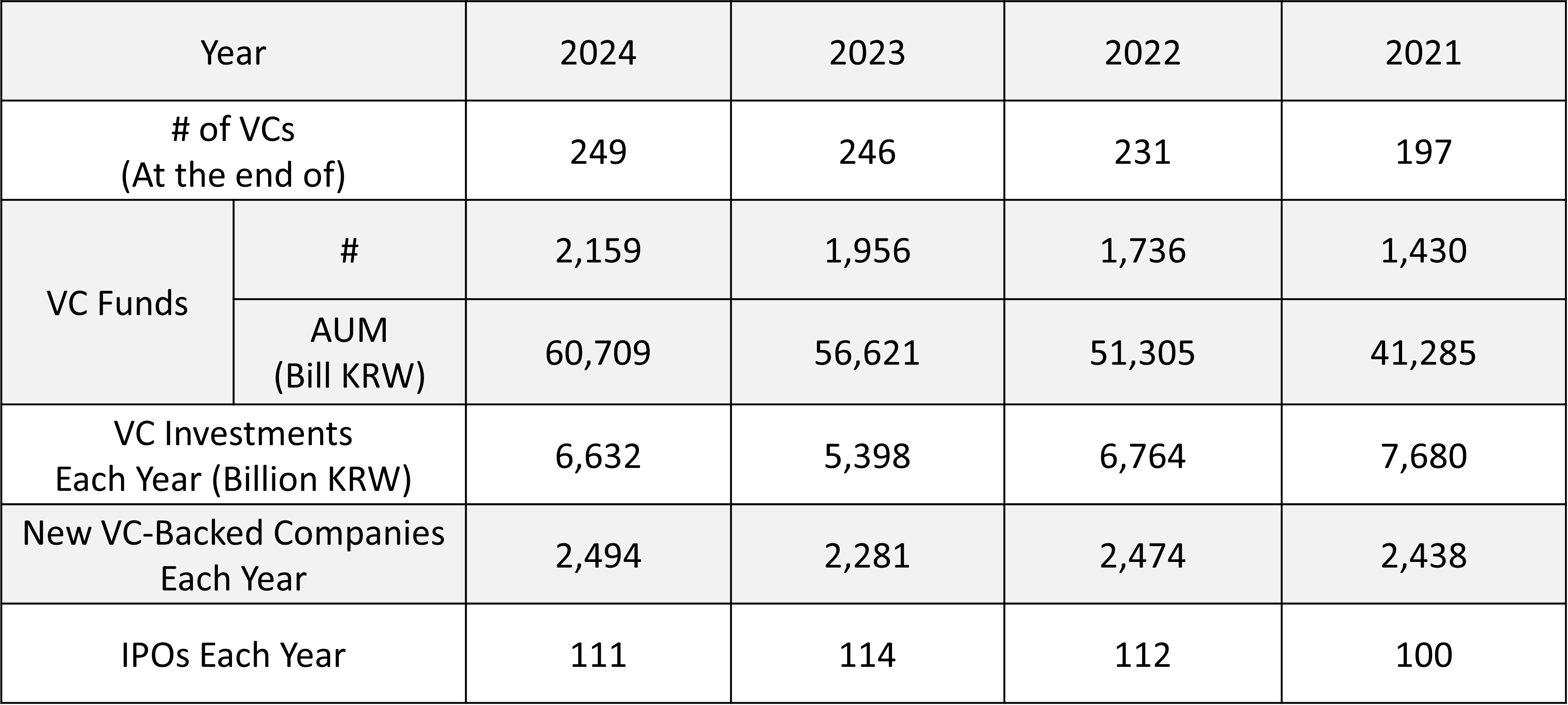

Annual VC-Backed Startups in Korea

Every year, over 2,000 startups in Korea receive venture capital funding—much more than the ones featured in our portfolio. This lively venture activity highlights the large flow of potential opportunities, making collaboration with BizCreation a special gateway to Korea’s vibrant venture ecosystem.

contact us

- 20f, 149 Sejong-daero, Jongno-gu, Seoul

- P.O, Box 03186

Please send your suggestions and requests.

Brief Case Studies on Portfolio Companies

For confidentiality, company names are not disclosed.

Next-Generation Silicon Anode Materials for Batteries

A VC-backed materials company developing high-performance silicon/graphite composite anodes for next-generation lithium-ion batteries.

The firm pioneers scalable processes such as plasma and granulation, securing patents and validation with global OEMs and cell makers. BizCreation supported the company through Pre-A and Bridge funding as a Virtual CFO, alongside growth and management strategy development. We also advised on vertical M&A opportunities to strengthen its position in the global EV battery supply chain.

Potential Partnerships

- Engineering & design collaboration

- OEM / pilot-scale manufacturing support

- Strategic alliances with global battery OEMs

- VC fund & Series A strategic investor matching / Vertical M&A

High-Efficiency Magnetic Components for EVs, ESS, and AI Data Centers

A Deep Tech power-electronics company providing next-generation inductors, transformers, and wireless-charging systems

A VC-backed Deep Tech manufacturer of high-efficiency magnetic components—inductors, transformers, and wireless-charging coils—crucial for next-generation EVs, utility-scale ESS, and AI data-center power systems. The company combines magnetic materials engineering (nanocrystalline and amorphous alloys), advanced electromagnetic and thermal simulation, and automated high-volume manufacturing into a Full-Stack Magnetics platform. Its technology is validated by global Tier-1 partners, including Hyundai/Kia, LG Energy Solution, LS Electric, and SoluM, and is integrated downstream into NVIDIA, Intel, and AWS server platforms. With mass-production capacity in Korea and Vietnam, the company is strategically positioned to scale into fast-growing markets driven by 48V ORV3 AI power architectures, GFM-based ESS inverters, and high-power EV ICCU/DC-DC systems.

BizCreation is currently supporting the company’s bridge-round fundraising as a Virtual CFO, including investment strategy, scaling readiness, international customer development, and M&A positioning to strengthen competitiveness in the global power-electronics supply chain.

Potential Partnerships

- Co-development of high-power magnetics for EV, ESS, and AI server PSU platforms

- OEM / Tier-1 mass-production support via Vietnam high-volume facility

- Strategic alliances with global EV, ESS, and hyperscale data-center manufacturers

- VC fund & pre-IPO strategic investor matching / Global vertical M&A opportunities

Advanced CNT Composite Materials for Fuel Cells & Semiconductors

A VC-backed materials company specializing in carbon nanotube (CNT) dispersion and composite technology, with applications across fuel cells, semiconductors, and advanced components.

The firm commercialized the world’s first CNT-based bipolar plates for fuel cells and supplies high-performance materials to domestic and global OEMs.BizCreation supported the company with pre-A fundraising as a Virtual CFO, as well as vertical industry partnership matching, engineering specialist connections, and R&D collaboration opportunities. These efforts strengthened its market positioning and accelerated commercialization in the clean energy and semiconductor sectors.

Potential Partnerships

- Engineering & design collaboration

- OEM / advanced manufacturing support

- Strategic alliances with R&BD institutions

- VC fund & Series B strategic investor matching / M&A

Functional Food & Cereal Innovation

A VC-backed company and pioneer in localized cereal production and functional food development.

BizCreation supported the company with Virtual CFO services for fundraising, growth and management strategy, and domestic and overseas partnership building. Additional expertise was provided in technology commercialization and matching engineering specialists, contributing to value creation and scalability.

Potential Partnerships

- Engineering & design collaboration

- OEM / contract manufacturing

- Distribution & technology transfer

- Matching with VC funds, Series B strategic investors, and M&A partners

Biologics & Biosimilar Development for Global Access

A unicorn-status, VC-backed biopharmaceutical company with end-to-end capabilities—from innovative antibody engineering (e.g., CHIMPS and SHOCAP bispecific technologies) to large-scale biologics manufacturing at its facility.

The company produces both novel drugs and biosimilars, including the first approved Korean antibody biosimilar. BizCreation supported the company in Series A fundraising via VC syndication, assisted in private fund structuring with financial institutions for facility expansion, and provided IPO strategy advisory, reinforcing its manufacturing capabilities and global commercialization path.

Potential Partnerships

- Biopharma R&D collaborations and clinical development alliances

- Manufacturing scale-up with contract production and facility partners

- Institutional investor syndication for global growth.

Open Source Software Security Solutions

A VC-backed company with deep expertise in IT, specializing in open-source software, compliance, and security.

BizCreation supported the company with a growth strategy and partnership building. Core technology includes a unique fingerprinting method that scans binaries directly—without requiring source code or reverse engineering—to identify security vulnerabilities and license compliance risks. This approach helps customers secure firmware and applications while managing open-source compliance.

Potential Partnerships

- Distribution & agency partnerships

- VC fund and Series B strategic investor matching

- Strategic alliances in software security and compliance

PET Recycling-Robotics & Smart Waste Management

A VC-backed company developing new waste trade markets using Industry 4.0 technologies.

It combines AI, robotics, and incentive models to sort recyclable waste and reward consumer participation.BizCreation supported the company with growth and management strategy, and domestic/overseas partnership development. The company leverages big data and robotics to identify, sort, and monitor recyclable materials in real time, driving both efficiency and sustainability.

Potential Partnerships

- Engineering & design collaboration

- OEM / contract manufacturing

- Distribution & technology transfer partnerships

- Matching with VC funds, Series B investors, and M&A partners

Wearable ECG Monitoring Solution

A VC-backed company offering long-term ECG monitoring solutions for arrhythmia diagnosis and patient care.

Its lightweight patch device enables continuous monitoring for up to 14 days with a single coin-cell battery.BizCreation supported the company through the Virtual CFO role, growth and management strategy, and partnership development in domestic and overseas markets. The company holds 32 ECG-related patents, including original sensing technology, signal processing algorithms, and AI-driven ECG analysis, establishing strong technological differentiation.

Potential Partnerships

- Engineering & design collaboration

- OEM / contract manufacturing

- Distribution & technology transfer partnerships

Network Semiconductors for Autonomous Vehicles

A VC-backed solution provider specializing in high-speed automotive link technology for next-generation mobility, including EVs and autonomous cars.

The company pioneered high-speed SerDes chips (up to 16Gbps) supporting global automotive standards, and develops automotive Ethernet solutions that reduce wiring cost, weight, and improve energy efficiency. BizCreation supported the company with early-stage growth and management strategy, and domestic/overseas partnership building. The firm’s technology combines robust control, reliable safety, and cost efficiency, making it a strong player in the evolving automotive semiconductor industry.

Potential Partnerships

- Engineering & design collaboration

- OEM / contract manufacturing

- Distribution & technology transfer partnerships

- VC fund and Series B strategic investor matching / Strategic M&A

Autonomous Driving Robotics (Level 4)

A breakthrough autonomous vehicle technology eliminating the driver’s seat, enabling full Level 4 driving where passengers engage freely.

BizCreation supported the venture with an early growth strategy, VC fundraising preparation, partnership development, and matching engineering experts, along with technology transfer support for commercialization.

Potential Partnerships

- Automotive OEM & Tier-1 collaboration

- AI & robotics engineering partnerships

- VC & strategic investors for Series A/B

- Licensing and technology transfer

Walking Assistance Technology (Elderly Care)

A healthcare innovation using Functional Electrical Stimulation (FES) to assist elderly mobility through intelligent electrode patches.

BizCreation provided growth strategy support, partnership building, engineering talent connections, and IR system preparation to position the company for fundraising.

Potential Partnerships

- Medical device OEMs

- Elderly care institutions & healthcare providers

- VC funds for early growth

- Technology transfer & co-development

Robotics for Elderly Support

A platform providing datasets and core AI technologies for training robots to interact with elderly users—covering vision, behavior recognition, and voice.

BizCreation assisted with partnerships, IR strategy, and expert matching to accelerate commercialization and build global collaborations.

Potential Partnerships

- Elder-care robotics companies

- AI & dataset research alliances

- VC & strategic co-investment partners

- Technology licensing to healthcare/robotics OEMs

VR Firefighting Training Simulator

An advanced VR system enabling realistic, safe firefighter training with multi-sensory immersion, motion simulation, and vital sign monitoring.

BizCreation supported early growth and commercialization strategy, IR readiness, and partnership development with R&BD institutions and design experts.

Potential Partnerships

- Firefighting equipment OEMs

- Safety training institutions

- Global distributors for VR solutions

- Co-investment and technology licensing

Cellular IoT for Smart Factories (5G Rel-15)

Industrial IoT solutions using 5G ultra-low latency networks to enable real-time control of robots, flexible manufacturing, and remote factory management.

BizCreation provided fundraising preparation, strategic partnership support, and engineering/R&BD matching to strengthen early commercialization.

Potential Partnerships

- Smart factory system integrators

- Telecom & 5G infrastructure partners

- VC and strategic investors in IoT

- Technology transfer for industrial automation

Satellite Communication ASIC Technology

A compact, low-cost ASIC-based satellite terminal combining transmission and reception, enabling easy use for disaster response and mobile communication.

BizCreation supported VC fundraising readiness, IR strategy, and partnership development with R&BD institutions to accelerate market entry.

Potential Partnerships

- Telecom and satellite operators

- Emergency/disaster management agencies

- Engineering design partnerships

- Strategic investors & licensing partners

Non-Contact Sensors with Ultra-High Sensitivity

Novel MoS₂ honeycomb-structured non-contact sensors with 660x higher sensitivity, enabling fast detection of humidity, breath, and sweat for healthcare and hygiene.

BizCreation provided growth strategy support, technology transfer search/matching, and VC fundraising preparation, including IR development.

Potential Partnerships

- Healthcare & consumer electronics OEMs

- Sensor engineering and material science partners

- VC and strategic co-investors

- R&BD and licensing collaborations

Micro LED Display SITRAB Technology

Innovative Simultaneous Transfer and Bonding (SITRAB) technology for Micro LED, reducing equipment cost/time by 90% and repair cost/time by 99%.

BizCreation supported early growth strategy, IR system setup, and strategic partnership development, including engineering and R&BD matching.

Potential Partnerships

- Display panel OEMs & device makers

- AR/VR and consumer electronics firms

- VC funds and Series A/B investors

- Technology transfer and licensing